Present and Probable Market Direction

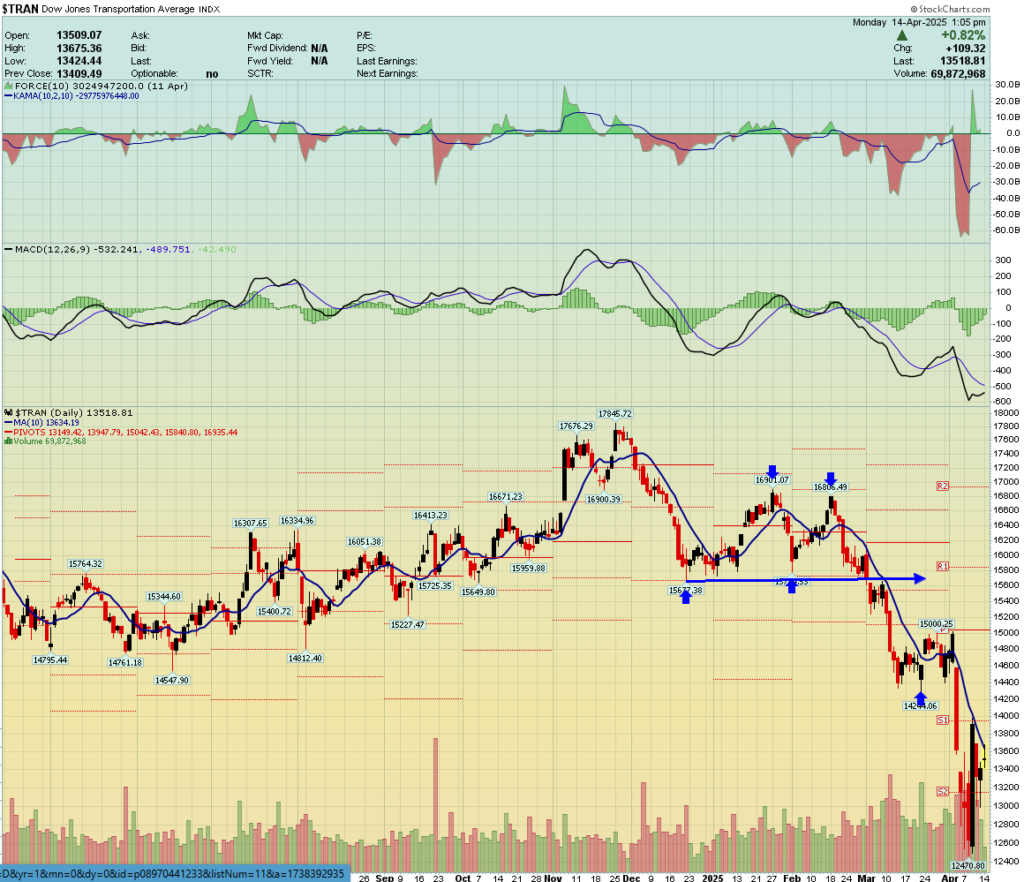

It will take a solid week of gains in both the Dow Jones Industrial Index and the Dow Jones Transportation Index to possibly confirm that the current downtrend in prices has ended. The Dow Industrial and Dow Transportation Average’s price trends must also confirm each other to give the market consensus for future prices. Once an intermediate downtrend is confirmed the idea is to wait for the index average to exceed the previous intermediate high which would indicate a stop of the downtrend and the potential beginning of a new uptrend. Remember that the majority of stocks, whether quality or not, go down when these Indexes are in a confirmed downtrend. It is a wise move to wait to invest in individual stocks until these indexes are in a confirmed uptrend. For long term core stock positions different types of loss mitigation strategies could be used during a downtrending market.

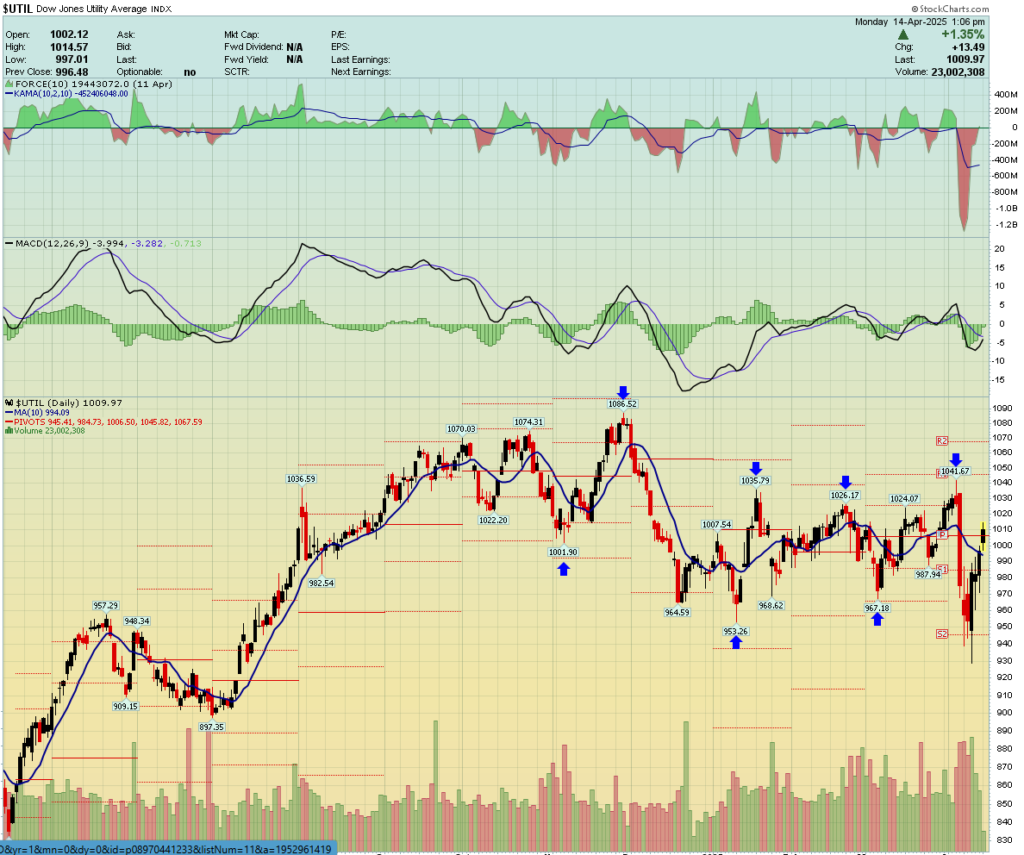

Also to watch is the Dow Utility average which can be used as an equity proxy for the bond market. The utility average components are regulated by the government to ensure they maintain sufficient cash flow for operations. Due to this they are usually consistent dividend payers. Currently the Dow Jones Utility Average has been forming a channel since the end of last year potentially signaling the bottom in the bond market sell off.

The highest yielding AAA corp bond yields are approximately 5.15% right now. Interest rates are a large component in valuing stocks. The higher the yield the more expensive for companies to operate.

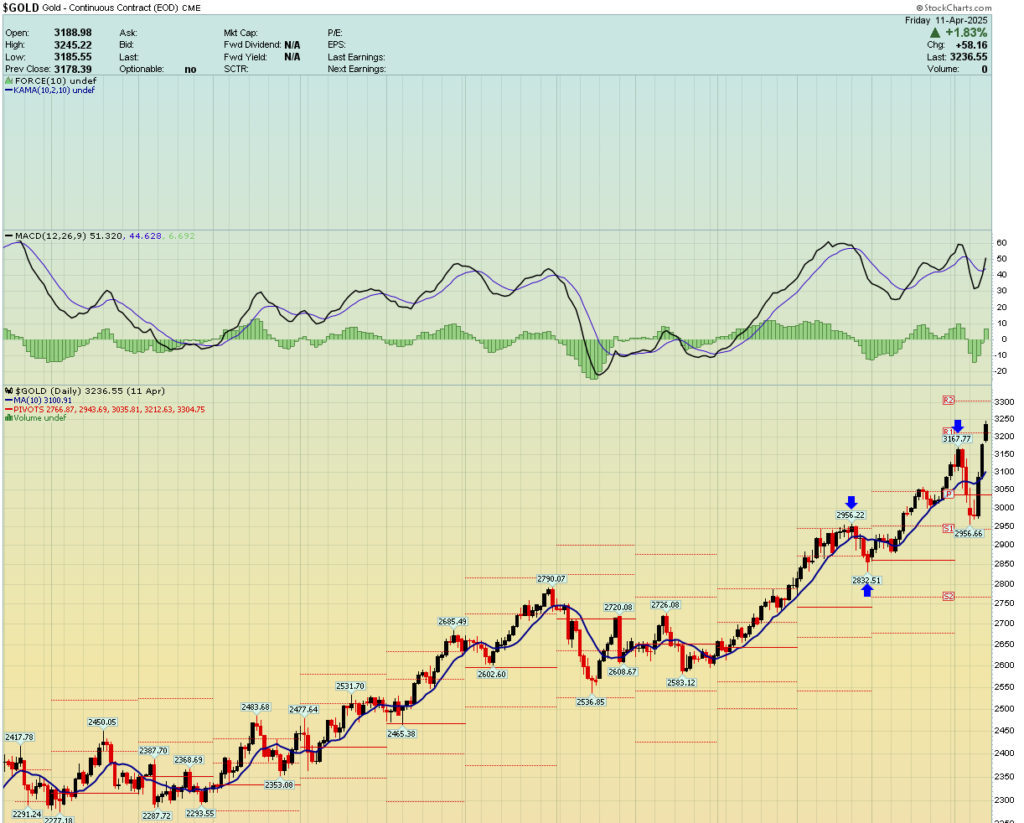

Gold continues its uptrend. See previous post concernint the Dow Jones Industrials and the Dow Jones Transportation averages priced as if gold was still being used as money.

Stock charts are provided courtesy of stockcharts.com