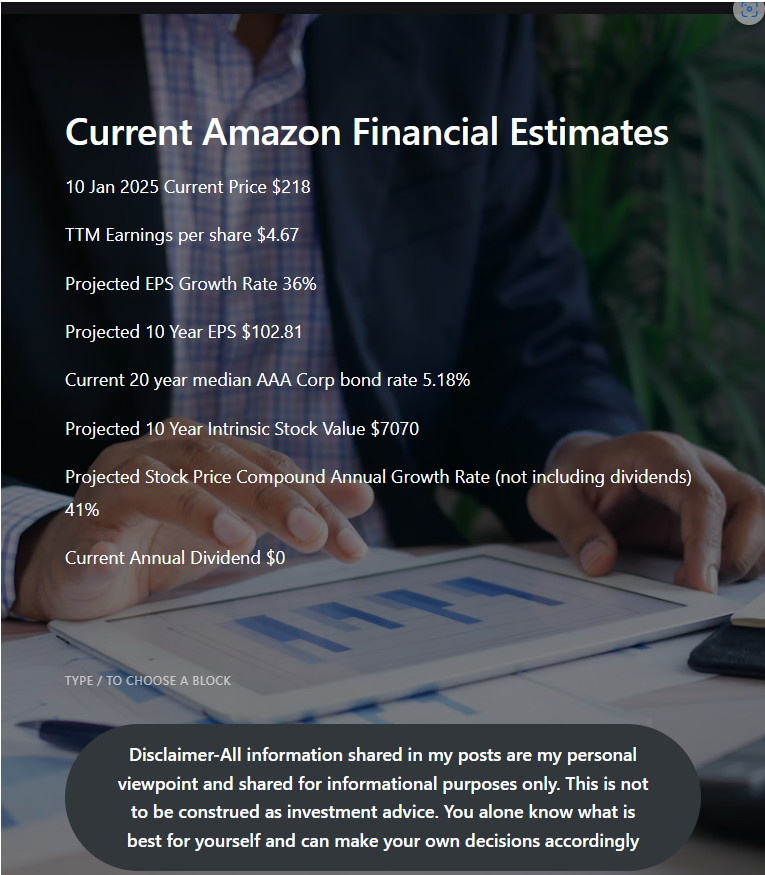

The following stock analysis is a repost to illustrate how to read the analysis-

-The current Price is the rounded price as of the date and time of the post.

-TTM Earnings means the Trailing Twelve Month Earnings for each share of stock.

-The Projected EPS Growth Rate is the estimated annual growth rate of the Earnings Per Share.

-The Projected 10 Year EPS is the projected value of earnings 10 years in the future using the previously mentioned Projected EPS Growth Rate.

-The Current 20 Year median AAA Corp bond rate is the rate AAA rated corporations potentially pay to borrow money (issue bonds to raise capital for business). These rates have a direct impact on the value of a business. Interest is the cost of money. When the cost of money is higher it impacts a company’s earnings in a negative way, and ultimately impacts the Intrinsic Value of the company.

-Intrinsic Value of a company is the theoretical value of the company based on several parameters. A company has a value and can be valued to make relative decisions on what a fair price is to pay for stock of that company. This principle is similar to when people value cars or homes.

-The projected 10 Year Intrinsic Stock Value uses the projected 10 year Earnings per share and the long term corporate interest rate to calculate the future potential value of the stock.

-The Projected Stock Price Compound Annual Growth Rate (not including dividends) is the annualized rate of return of the stocks current price needed to achieve the projected 10 Year Instrinsic Stock Value.

-Dividends are paid out by the company and would be in addition to the projected Annual Growth Rate.