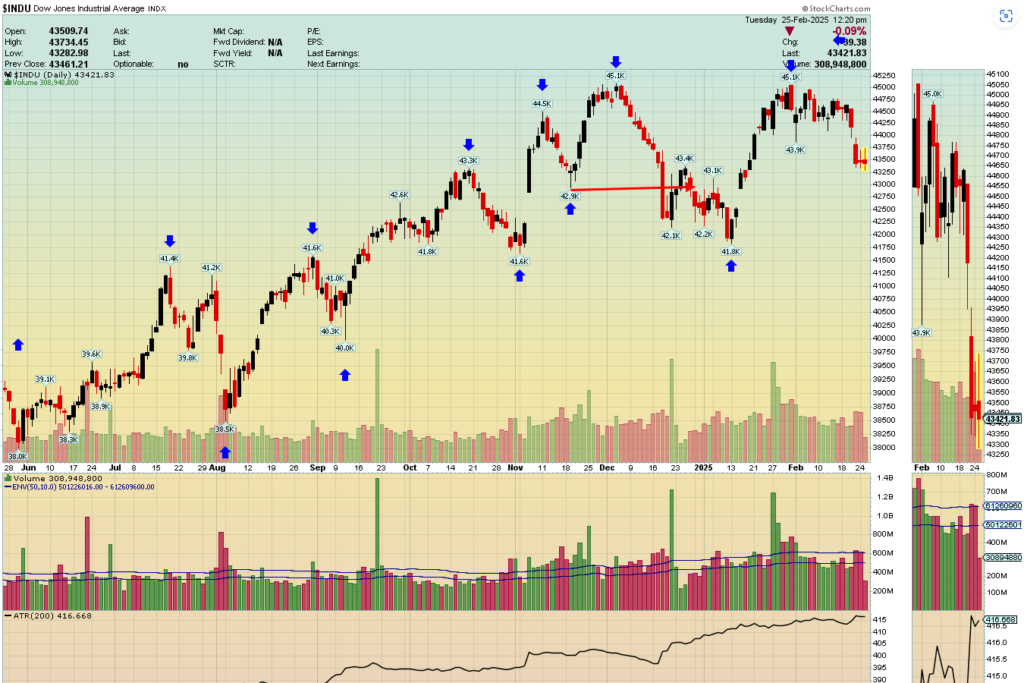

Present and Probable Market Trend

25 February 2025

Both the Dow Jones Industrials and the Dow Jones Transportation Indexes have formed new intermediate price highs. These new intermediate price highs are lower than their previous price highs. This is consistent with the traditional making of a downtrend- lower lows and lower highs. What this forecasts is probable lower prices in the near term future. Remember, both the Dow Jones Industrials and the Dow Jones Transportations most be in a confirmed trend in the same direction for the forecast to be valid. Both indexes would have to breach these intermediate highs to the upside in order for the downtrend to be reversed. Keep your eyes open for the next confirmed intermediate bottom in each index.

The stock universe I track is the Dow Jones Composite Index which includes the Industrial, Transportation and Utility Indexes. In addition to these stocks are Gold, Long term US government bonds and the US dollar. It is a buyer beware market and will stay this way until the downtrend reverses. Of the 65 stocks followed there are what I consider 19 Margin of Safety growth stocks. Of these Margin of Safety Growth stocks only 5 are still considered to be in an uptrend. Remember, both the Dow Jones Industrials and the Dow Jones Transportations most be in a confirmed trend in the same direction for the forecast to be valid.

Charts are courtesy of http://stockcharts.com