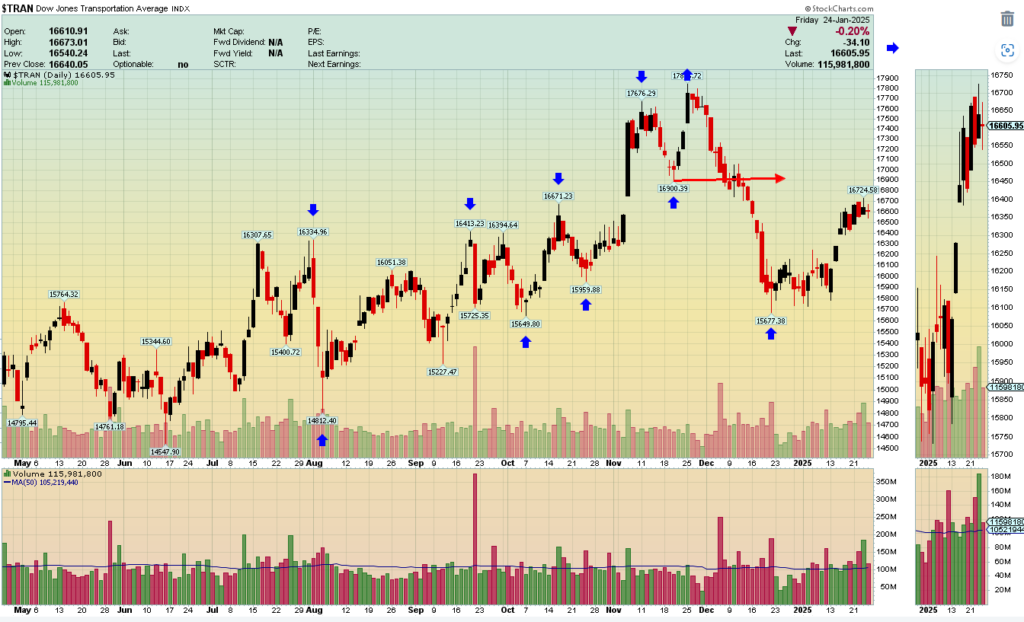

Present and Probable Market Trend

26 Jan 2025

The Dow Jones Industrial Average and the Dow Jones Transportation Average have both confirmed a near term bottom and have been rallying. Neither of these averages have confirmed a near term top yet. A near term top needs to form in both of these averages to establish a recent trading range. Once this range is established both Dow Jones Industrial Average and the Dow Jones Transportation Average need to break out of the top or the bottom of this newly formed range. A breakout to the upside will mean a resumption of the primary bull market. A breakout of the bottom of the range will mean a continuation of the market correction. Both averages need to ‘break the range’ to confirm. Remember that both Dow Jones Averages need to be in sync to confirm a trend.

The previous all time highs in each index need to be watched also… Both indexes were in a primary uptrend (which means long term).

Disclaimer-All information shared in my posts is my personal viewpoint and shared for informational purposes only. This is not to be construed as investment advice. You alone know what is best for yourself and can make your own decisions accordingly.